While driving home from a far away baseball game earlier this week, the dashboard of our 2005 Tahoe lit up like a Christmas tree.

This is one of those moments when you wonder if the savings of buying an older vehicle is worth it.

Our whole family was in the car, and all Google could tell me was that it could be as simple as a sensor…or as awful as the steering and brakes not working while you’re flying down the highway.

Lovely.

We made it home safely and now we’re waiting on word of how much this repair is going to cost us.

And I’ve decided to try to keep track of the amount of money in repairs (as well as the time we are without a vehicle) so we can see if driving an older car is truly worth the savings.

What do you think about driving older cars?

While the car repair isn’t going to be cheap (I’m sure), we did find other ways to save money this week.

The 5 Ways We’ve Saved Money This Week

VBS

It’s Vacation Bible School season in our area! Many Moms I know take their kids to different churches all summer long to attend VBS.

In our area, most of these day camps are free or very low cost.

Some of the places will even serve them a meal!

If your local VBS costs too much (I was surprised to hear that some areas charge quite a bit!), look in other smaller towns to see what options are available.

New (Medical) Year

I bet our insurance company is just loving us this year! (/sarcasm)

Between having a baby, 2 surgeries, multiple MRIs, plus all the usual check ups, ER runs, and medications, we’ve been extra thankful for insurance coverage this year.

Our insurance year flips over in July. We’ve (obviously) met our deductible for the year!

So I made some appointments and picked up some prescriptions that are free right now…but next week will cost us hundreds of dollars again.

If you have “use it or lose it” money in an FSA and your insurance year starts over in July, don’t forget to use it up!

Snacks

One of my favorite ways to save is to take along snacks and drinks.

I’ve done well taking drinks to our baseball games this year. But snacks…not so much.

Adjusting to life with a new baby is challenging, and I haven’t been the most prepared Mama ever.

So this week when I remembered to take along snacks for our games, I was excited! We still have a lot of games ahead of us, so I hope this savings will continue to roll on.

Gifts

We had a birthday boy in our house this week! Our newly minted 12 year old has been wanting a replacement Wii for the one that broke. (I shipped it off to Decluttr a while ago and at least got a little money from it!)

So I went to GameStop and found one for pretty cheap!

They have an automatic 30 day guarantee so you can make sure everything is working properly. And you can buy an extended warranty, too.

I decided against it, but it could be a good deal if your kids are rough on things.

Coupons

Back in the day, I could just buzz cut my boys’ hair with some clippers and be done.

These days, my teenagers want something beyond my extremely limited hair cutting skill set.

So we’ve been going to Great Clips. This week I was able to use this coupon for $5 off!

And…A Big Savings Update!

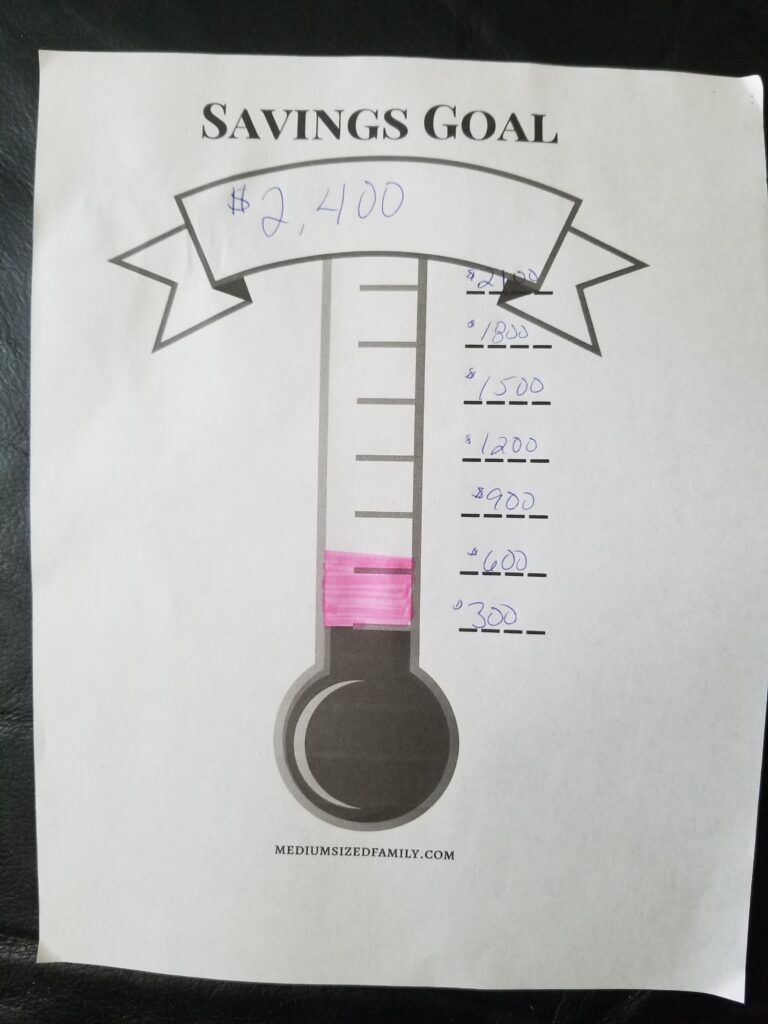

This summer, our family has set a BIG goal to save up $2400.

The savings started out with a bang! We were able to do pretty well in our first couple of weeks.

Good thing, because this week wasn’t quite as stellar. 😉

I’ve still only managed to list one thing on eBay. But I’ve already sold it!

That added $30 to our savings.

Here’s my eBay selling method if you’re curious.

Then I decided to check my Ibotta balance.

There I found $36.91!

If you haven’t tried Ibotta, it’s a savings app that gives you rebates on things you buy. (From groceries to clothing to a whole variety of things!)

Even if you already used a coupon to get the item in the store, you can still get money back!

It’s an easy way to stack up your savings. You can try Ibotta yourself here.

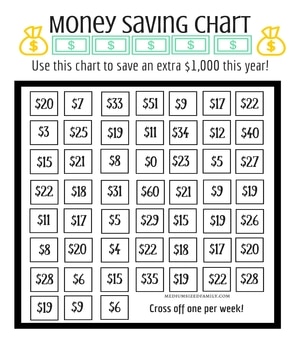

Here’s what our savings chart looks like so far. (Print your own here!)

The plan for next week to help cushion the savings fund:

I’m hoping to get some clothes sold to consignment shops.

List more items on eBay.

Try out this new savings app called Affinity I just learned about. You get an extra $3 just for downloading the app!

Happy savings!

I hope you’ve been able to find ways to save this summer, too. Don’t forget to join the mailing list for extra money saving tips!

[et_bloom_inline optin_id=optin_8]

How did you save this week?

Hi Jamie, I still believe driving an older vehicle is worth it. We bought a SUV the same time you bought yours. It was a used vehicle as well yes we are having some issues but it’s still better than having to write out a payment every month. Just make sure you trust who take it to. They also have awesome You Tube videos on how to do somethings yourself. We have been using that one a lot this summer already. Good job on still saving this week. Have a wonderful 4th of July.

Unfortunately, fixing it ourselves isn’t an option. I wish it were! Even the cost of used vehicles is so high now, and paying for a newer car would be such a high monthly bill. I’m sure you’re right about the savings. It’s just frustrating when you’re without a vehicle!

My husband and I drove older cars most of our marriage and said that repair bills were less than car payments. 5 years ago my dad died and I got his 7 year old Accord that had under 30000 miles on it. I put about 1000 dollars into it for tires brakes etc and since then I’ve replaced the battery and done routine maintenance. I felt safe taking the kids out of state into the mountains in that 11 year old car. My husband ‘s car but the dust and we bought a year old Accord , financed at under 2%. Routine maintenance only and it will be paid for in two months. It cost twice what we hoped to spend but we could afford it and definitely think we’ve gotten out money worth

I tend to drive my vehicles into the ground. Sold my 1998 Ford Escort Cpe in 2017. Purchased a used 2014 Buick with all the bells and whistles and only 14,000 miles on it for only $10K. It was a good find, the car was pristine and so far I haven’t had a single issue.

The tricky part is to find a reliable mechanic who fixes your baby at a fair price and will honestly tell you when a used part is just fine and give you options if it happens to break down in a month when there is no money in the kitty:)

Yes, you need an emergency fund or a dedicated car repair fund because a car needs maintenance and once it is past seven years you may have to replace parts.

Overall, you will be way ahead by not having a car payment.