by Jamie Jeffers | Apr 27, 2018 | Ways We Saved This Week

My middle schooler walked with me into the store and helped me lug bags of dog food this week. I paid for everything with my debit card as usual, and we left.

On the way home, he asked why I was still using a credit card. And I realized that we hadn’t talked about the difference between debit and credit in a while.

It reminded me of a talk I heard recently. A mom was imploring other women to read real books. When we read on our phones or a tablet, our kids always assume we are playing games. (After all, that’s what they do on a tablet!)

But there’s no denying a physical book.

What appearance are we giving to our kids when we spend or save money? Using cash is a better way to show them good money habits. But in a society that is getting farther away from paper every year, it’s a good idea to explain the concept of a debit card to your kids. And tell them why it’s different from borrowing money!

(more…)

by Jamie Jeffers | Apr 23, 2018 | Happiness & Giving, Parenting & Household Tips

Inexpensive thank you gift ideas are just what you need to keep your volunteers going. They’re amazing, and they need to know it!

We all know that one person who works tirelessly to volunteer and give, give, give. If you’re lucky, several people come to mind! They don’t do it for money or appreciation. But you know what? Appreciation never gets old.

You don’t have to give them a gift card for a fancy restaurant. Little touches go a long way when it comes to brightening someone’s day.

And if you’re tasked with getting a pile of thank you gifts for everyone who volunteered at the school this year, no worries. This list should help you get the job done and stay inside the budget!

So even if you’re pinching pennies or going through a #yearofno, you can still find ways to make the good people in your life feel valued. After all, no one likes the division in people that’s in the news every day. You can bring people together, and it has to start in our small communities.

(more…)

by Jamie Jeffers | Apr 20, 2018 | Ways We Saved This Week

Baseball season is in full swing. That means choosing between eating supper at 4:30 (sometimes 4:00) or 9:00. (Or, if you’re a teenage boy, the answer is, obviously, both.)

Sometimes eating on the go is just a must. Using my handy snacks for trips list has helped, but I’m planning to add to my bag of tricks this year! If you have a favorite tip for eating meals on the go (and avoiding fast food or dropping $20 at the concession stand), let me know in the comments!

(more…)

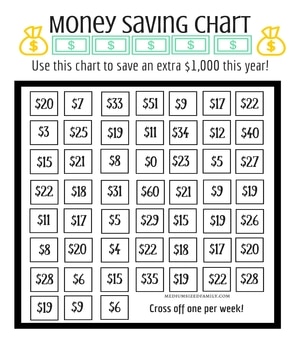

by Jamie Jeffers | Apr 18, 2018 | Saving Money

If you’ve struggled with money for years, putting together a money saving plan might sound impossible. But it’s just what you need to build a savings cushion! And it’s easy to get started. Here are the steps you’ll want to take today.

Ever get a windfall of money you weren’t expecting?

I mean, it doesn’t happen often enough, right?

But when it does, there’s always that moment when your brain feels a little torn about what to do with it.

It would be easy to waste it all in a hurry. You have a list a mile long of things you’ve always wanted to own and big projects you’ve been wanting to pull off for ages.

But is that the best way to use that wad of cash?

See, this is why having a money saving plan in place is such a great idea. It’s takes all the extra brain work out of the equation.

(Because sometimes extra brain work leads to a little too much thinking. Which leads to decision fatigue. Which leads to you wondering what happened to all that cash.)

(more…)

by Jamie Jeffers | Apr 16, 2018 | Large Family Life

Spending quality time with the individual members of your family is vital. But how can you make it a priority when you never have enough time or money? Here’s how to make it work.

Time is the “currency” of relationships. There’s no way to invest in a relationship without investing your time. ~Dave Willis

You can spend all of your money on your kids, but we all know what they really want is our time. That can be tough to do when you have a large family or a busy schedule.

And you can do this without draining your wallet on fancy events or season tickets. Today, let’s talk about spending quality time with your family in a way that won’t put you in the poor house.

(more…)

by Jamie Jeffers | Apr 11, 2018 | Income, Secure Your Savings

Becoming a search engine evaluator can be a great way to work from home while earning a good income. Here’s everything you need to know to land the job.

Ninety-three percent of online experiences begin with a search engine. (source) So chances are that you have done a few internet searches in your day. Probably even today!

Have you noticed how much Google and other search engines have improved over the years? Once we had to sort through pages of information to find what we were looking for. Now, Google can find you the answer to just about any question in no time flat.

That’s all thanks to the work of search engine evaluators.

It’s a necessary job, and one that you just might have the skills to try out yourself! But just what does it take to land a job as a search engine evaluator? Let’s talk.

(more…)

by Jamie Jeffers | Apr 9, 2018 | Income

Learn how to tell legitimate full time work from home jobs from the scams. You won’t believe how many options there are! You’re sure to find something that matches your talents with the perfect line of work..even if you have no experience.

You’re ready to make the leap.

You desperately want to stay home with the kids. Or you need extra income to pay off debt.

Maybe you have to escape a dead end job before it swallows you.

Or you just need to know whether you can make it on your own.

It’s time to find a full time work from home jobs out there fits your life.

You’re tired of reading about how you can take surveys or watch ads to make pennies for your time. No, you’re ready for a legitimate job.

You know it’s going to take some effort and time to make that income, and you’re ready to tackle it.

Let’s talk this out. Today you’ll learn which full time work from home jobs fit you based on:

- How soon you need money to start coming in.

- How much risk you’re willing to take.

- Which area fits your strengths.

- The first step you need to take to get started.

So if you’re serious about finding a way to earn real money from home, let’s do this.

(more…)

by Jamie Jeffers | Apr 5, 2018 | Ways We Saved This Week

This week I put together our goals check in for April, and I’ve gotta tell you…it’s way more fun to write goals when you aren’t giving all your money to credit card companies!

Of course we aren’t splurging on a bunch of “stuff” now that we’re debt free. (Ok, we did a little splurging on our trip last week!) Most of that debt money is now going to fill our savings account.

But watching money build in an account is a million times more fun than sending it off to pay for things you bought years ago. It seems so silly that we lived that way for so long! Setting those big goals was sooooo worth it!

(more…)

by Jamie Jeffers | Apr 4, 2018 | Goals

There is no way we’d have paid off tens of thousands in credit card debt without our beloved goals. That’s why I love to share our goals progress each month! I hope that showing you snippets into our life as we pay off big chunks of debt is inspiring and helpful.

But I didn’t do a March update this year. I started to pull it together…but there was just nothing to tell! We hadn’t finished our credit card debt yet. And since most of our goals for the year are waiting until we can pay cash to meet them, we didn’t make progress in those areas, either.

But that’s ok. The wait was worth it. Because after 27 months of chunking away at tens of thousands of dollars in credit card debt, I can finally make the announcement I’ve been dying to type for years.

(more…)

by Jamie Jeffers | Mar 30, 2018 | Ways We Saved This Week

One evening, when our #yearofno was wearing thin (and getting on our nerves a little bit), Hubby and I talked about the first thing we’d do when we were free from credit card debt. We considered a few ideas, but finally decided that a little getaway was the perfect reward for our family.

We sent in our last payment a couple of weeks ago! So we decided to book a hotel for one night of spring break. We took the kids to Indianapolis for a couple of days of fun.

I can’t tell you how relaxing it is to get away with the family on a trip you can cover with cash. It felt truly rewarding after years of looking for free things to do over spring break.

Not that there’s anything at all wrong with having a frugal or free spring break. You can bet we’ll still have plenty of those in our future! But sometimes a cash splurge is just what the doctor ordered.

(more…)